Contents:

Silver yesterday settled up by 0.19% at as risk sentiment was hampered by concerns over the health of the global banking sector. Since this is a registered and regulated platform, it requires your name, date of birth, as well as contact information. It will also require you to provide certain documents in order to confirm your identity. It consists of at least 99.5% pure silver, and it comes in the form of bars or ingots.

Is silver finally out of the woods as China reopens and the Fed slows … – Capital.com

Is silver finally out of the woods as China reopens and the Fed slows ….

Posted: Thu, 08 Dec 2022 08:00:00 GMT [source]

Admiral Markets has relatively high minimum deposit requirements for some account types, such as those in GBP. Trades are dealt with somewhat in an unexpected way, in spite of the fact that for the trader the involvement is nearly indistinguishable. In spread betting, the contract measure is decided by the sum of money that the trader is ready to stake per point.

Trading gold and silver online

Most trades are executed in less than 10 milliseconds and only 9% of orders receive negative slippage. These execution statistics are ideal for traders who want to take advantage of MT5’s algorithmic trading capabilities across a range of assets. OctaFX offers CFD trading on three trading platforms – MT4, MT5, and its own in-house platform, OctaTrader.

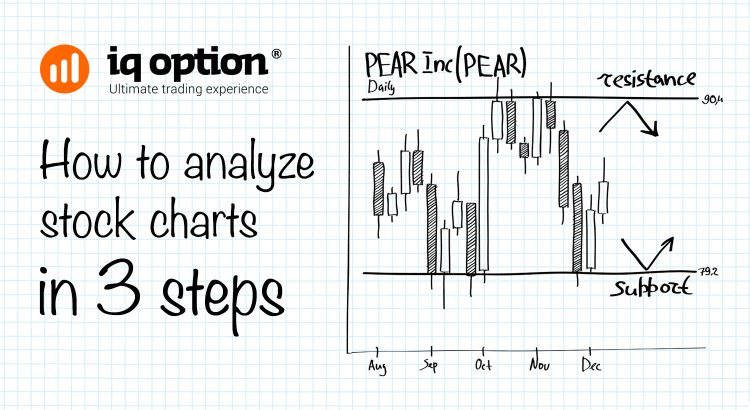

Users can compare and select from a range of financial products and services, allowing them to make the best decisions when it comes to their finances. MyPaisa Finance Portal is a one-stop shop for all your financial needs. This type of trading strategy works with trading silver and gives demonstrations of the current market trend. This market trend provides a strong market momentum replicating a future expectation of the market, whether it is trending in the same direction. In this strategy, investors can perform several prices from the history and the current one, compare them to get a better analysis, and place their orders accordingly.

- There are plenty of scammers in the world of investment who just want your money, and they are not picky about how they are going to get it.

- It is concerned with application of numerical methods for solving conservation equations of fluid dynamics.

- There is also a limit of $2,000 per withdrawal, so this method can be limited if you wish to work with larger figures.

- The main difference between CFD trading and traditional trading is that when you trade a CFD, you are speculating on a market’s price without taking ownership of the underlying asset.

By Ambar Warrick Investing.com — Gold prices fell slightly in Asian trade on Wednesday, but hovered around key levels as markets awaited more cues on U.S. monetary policy from a string of… Yes, it is possible to buy physical silver with online brokers. However, that comes with additional concerns, such as storage and insurance. Finally, we would also point out the fact that your profits from silver in India are subject to taxation. Specifically, the country’s laws say that the long-term capital gain is charged at 15%. However, if you make money from silver that you have held in your portfolio for less than 36 months, that will be treated as a short-term capital gain.

India helps silver demand glitter at new high in 2022

After you locate the on the list, click the Show Symbol button to add the asset to Market Watch. Best Laminates for usage in Living Room,Bedroom,Offices,Restaurants among others. Trade Derivatives on Gold and Silver with HF Markets and get a competitive edge in the dynamic precious metals market. There are other differences between the two types of trading, with some that give CFD trading an advantage and some that make CFD trading riskier. This course is introductory in nature and expected to impart firsthand knowledge of CFD. It is mainly aimed for senior undergraduate students/ first year post graduate students in Aerospace, Mechanical, Applied Mechanics, Applied Mathematics and allied streams.

Bullions are often kept by governments and central banks as reserve https://1investing.in/. Over 40,000 active clients from 110+ countries, carrying out an average of 1.5 million trades per year. We came up with the top two brokers that offer the best features, which include Libertex and Admiral Markets. With all that said, you might be wondering what is the best way to actually buy silver? Well, in this day and age, the easiest and fastest way to get silver at fair prices is to buy it online. The CFD is basically an agreement to trade the difference between the opening price and closing price of the security, which is being exchanged.

Gold and Silver Technical Outlook: Settling in a Range? – DailyFX

Gold and Silver Technical Outlook: Settling in a Range?.

Posted: Mon, 30 Jan 2023 08:00:00 GMT [source]

Tradeable CFDs include 32 currency pairs, gold and silver, energies, indices and 30 cryptocurrencies. A 50% deposit bonus for each deposit is available, as well as demo contests with cash prizes. OctaFX always runs contests for traders with live accounts, and prizes include cars, laptops and smartphones. Be aware that all these bonuses have terms and conditions that must be met.

and access global financial markets

Generally, energies are innately volatile markets because of the direct impact that world events can have on supply. Access the global markets instantly with the XM MT4 or MT5 trading platforms. In a world where trading conditions and customer support can vary based on where you live, our broker reviews focus on the local trader and give you information about these brokers from your perspective.

Thus, make an account on digital platforms and start trading digital silver. They are much more valuable than buying physical forms of silver from local jewelry shops. The MT5 account at FxPro offers market execution, variable spreads, no requotes and will allow for partial fills for orders that lack liquidity. The MT5 account is commission-free with spreads sometimes down to 0.6 pips, though traders will find that the average spread on the EUR/USD is closer to 1.2 pips. FxPro offers a range of technical analysis indicators from Trading Central for MT5 as well as a free VPS service. An FCA regulated CFD broker with tight spreads over three simple account types, XM offers trading on Forex, shares, commodities, indices, precious metals, and energies.

What fees should I expect to pay when investing in Silver through an online broker? Account opening and deposits typically come with no fees, but you might encounter trading fees, inactivity fees, and potential withdrawal fees. It is hard to say because each broker has its own policy, so make sure to do your research before committing to one.

Small-Cap Stock Paying Rs 47/Share Dividend to Turn Ex-Dividend This Week

HFM is a global CFD broker with regulation from the FCA, CySEC, FSCA, and the CMA. It provides a variety of CFDs including Forex pairs, commodities, indices, shares and crypto. HFM offers lightning-fast STP execution and access to 1000+ CFD instruments on all four different accounts that it offers. The minimum deposit on the Micro Account is exceptionally low, at 5 USD and spreads start at 1 pip on the EUR/USD. For beginners, HFM offers unlimited demo versions of all its account types. For more experienced traders, the HFM Zero Spread Account offers spreads down to 0 pips for a 200 USD minimum deposit.

Silver Price 2023 Outlook: Will Silver Underperfom Gold in 2023? – Capital.com

Silver Price 2023 Outlook: Will Silver Underperfom Gold in 2023?.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

Libertex also offers a range of educational resources, including webinars and tutorials, designed to help traders improve their skills. MT4 and MT5 trading accounts can be opened with a minimum deposit of 100 AUD. Average spreads on the RAW Account are 0.1 pips (EUR/USD) and commission on this account is 6 USD round turn, making the total trading costs at the low end for the industry.

XTB – Best Proprietary CFD Trading Platform

In 2014, India came close to winning the World Cup twice in Stage 2 Medellin and Stage 4 Wroclaw, but on both occasions they ended up losing. The Indian men’s recurve team clinched a silver medal after losing to China by the thinnest of margins in a shoot-off at the Archery World Cup Stage 1 here on Sunday. Silver yesterday settled down by -1.12% at as markets expect the U.S. Federal Reserve to opt for a higher or longer interest rate stance to control inflation.

The next step will be to choose a type of account since Admiral Markets offers multiple account types. That includes demo accounts, which are useful for inexperienced traders, where they can practice trading. Alternatively, for experienced traders, there are live accounts so they can engage in trading straight away.

Select an account that fits your needs, and hit the “Open Account” button. Specifically, learning how to use and navigate them, as this is key to learning how to buy silver on these platforms. With that said, understanding the trading platform of the selected broker should be one of your top priorities. Let’s say that you wish to use Admiral Markets to place a buy order for silver CFDs. First, you would have to sign up with the platform and register for a Trade.MT5 account.

- One downside to bank transfers is that withdrawals can take up to five business days.

- Silver yesterday settled up by 0.58% at as the dollar falls as a result of Fed members’ aggressive views.

- The first thing to note is that there are different types of silver investments.

- For example, Skrill lets you make instant withdrawals, with a 1% commission.

Investing.com — Gold prices kept to a small range on Thursday as traders hunkered down ahead of hotly watched data on U.S. economic growth and the Federal Reserve’s preferred… Silver yesterday settled down by -0.6% at as traders strapped in for U.S. economic data for further guidance on the Federal Reserve’s monetary policy stance. Investing.com– Gold prices fell slightly on Friday, extending losses into a third straight session as stronger-than-expected U.S. inflation and labor market data saw fears of more Federal… When the silver trades are closest to the resistance mark, the commodity is overbought, and it’s time to exit from the trend to achieve higher profits. We have around 120 members in the group now including nearly 50+ SC, ST alumni.

IRESS trading accounts require higher minimum deposits, starting at 1000 AUD for the Standard Account. IRESS trading accounts also attract a brokerage rate, IRESS platform fee and an ASX Live Data fee unless a minimum monthly commission is reached. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. XAUXAG reflects the relation between dollar values of two popular trading instruments, gold and silver.

It represents the likelihood, or probability, that one of the individuals involved in a transaction might default on the contractual obligation that they accepted. Basically, one of the participants in the transaction might fail to deliver, thus leaving the other party at some sort of loss. Overall, Libertex is an excellent choice for Indian customers looking to trade gold. With competitive pricing, a user-friendly platform, and a range of educational resources, Libertex is a reliable broker for traders of all skill levels. It’s important for forex traders to educate themselves on the risks involved in CFD trading and to develop a solid risk management plan to help mitigate these risks.

This matteoutline of trade because the short-term capital gain is only charged at 10%, so you get to save up a bit extra. As a result, it pays to keep an eye on the dates of your purchases and make sales accordingly. Basically, wait for the best opportunity within 36 months, and you will be able to pay 5% less on your gains.

Leave a Reply